A civil court in Pune has rejected an injunction application filed on behalf of pharmaceutical company Cutis Biotech against Serum Institute of India, seeking Serum Institute to restrain from using the trademark ‘Covishield’ for its Covid-19 vaccine.

Cutis-Biotech, a pharmaceutical products manufacturer and seller based in Maharashtra, had filed a suit in the civil court seeking to restrain SII from using the trademark ‘Covishield’ or any other similar names for its Covid-19 vaccine, claiming that the pharma company is a prior user of the brand name. After this, Pune based Serum Institute replied by saying that since both the companies operate in different product categories and there is no scope for confusion over the trademark. Justice A.V. Rote of Pune Civil Court rejected the application which had sought a perpetual injunction against Serum Institute of India for purposes of restraining it from using the trademark ‘Covishield’ or any other mark which is confusingly similar to the trademark Covishield in respect of the goods which are same/similar/dissimilar with the goods of the plaintiff. In addition to this, the court also observed that the court also observed that the Plaintiff Cutis Biotech has not approached the court with clean hands and had suppressed material facts. Following this, the Plaintiff firm through its advocates had also stated that the firm would be preferring an appeal in higher appellate courts, following the order of Pune Civil Court.

For more information regarding Intellectual Property laws, please visit http://www.trademarkiso.com/law/intellectual-property-rights/.

The Hon’ble Supreme Court discards a plea by Chennai-based firm Arudra Engineers seeking restrainment on Patanjali Ayurved from using the trademark ‘Coronil’ for its immunity booster medicine. Arudra had challenged a Madras High Court order declining to restrain Patanjali from using the ‘Coronil’ name for its immunity booster product that was launched by Ramdev with much fanfare. Arudra, which makes sanitisers and chemicals, has claimed that the trademark name ‘Coronil’ has been owned by the company since 1993. A single judge bench of the Madras High Court had given relief to Arudra but a division bench later stayed the single-judge order.

The petitioner had claimed that they have been using the mark ‘Coronil’ since 1993 and the product associated with the brand name is an acid inhibitor which is used in industries. The Supreme Court said, “In these Covid times, if we prevent the use of word Coronil, it will be terrible for the product (of Patanjali)”.

The Supreme Court dismissed Arudra’s plea and asked them to pursue the matter before the division bench of the Madras High Court, which will hear the matter in September. The case pertained to a trademark dispute, not related to the merits of branding or the efficacy of the formulation of products marketed under the brand name ‘Coronil’. The appeal stays to be reviewed in the month of September.

A Chinese Firm Chinese firm Shanghai Zhizhen Intelligent Network Technology Co, Ltd, also known as Xiao-i was recently awarded a patent for a voice assistant with similar features to that of Apple’s Voice-Assistant ‘Siri’. The Chinese firm has recently filed a patent lawsuit against Apple Inc., alleging patent infringement and has claimed about $1.43 Billion in damages and also demands that Apple cease “manufacturing, using, promising to sell, selling, and importing” products that infringe on the patent, it said in a social media post.

The Chinese company had argued that the Voice Recognition software ‘Siri’ by Apple Inc. infringes a patent that the firm had applied in 2004 but was granted to them in 2009. Shanghai Zhizhen first sued Apple for patent infringement in 2012 regarding its voice recognition technology. In July, China’s Supreme People’s Court ruled that the patent was valid. China is Apple’s largest foreign market in terms of sales and this legal action has emerged when a potential trade war seems to be happening between the United States of American and China.

Apple said it’s looking forward to defending its software in court. “This case has been going on for 8 years,” an Apple spokesperson said. “Siri does not contain features included in their patent, which relates to games and instant messaging, and we are disappointed Xiao-i-Robot has filed another lawsuit. Independent appraisers certified by the Supreme People’s Court have also concluded that Apple does not infringe Xiao-I-Robot’s technology.”

This lawsuit isn’t the first run-in the two companies have over this particular patent. Xiao-i had originally lodged a lawsuit back in 2012, but Apple filed a request to have the patent invalidated. The discussion over whether the patent is valid has continued for eight years, but last month China’s Supreme People’s Court ruled in Xiao-i’s favor, reversing a previous decision reached by Beijing High Court. Xiao-i is using this latest decision as fuel to renew its original patent infringement claim. The company, which specializes in natural language processing, said it filed the formal lawsuit with Shanghai High People’s Court.

Apple didn’t immediately respond to request for comment.

After being in the news in recent times, the controversial drug of Patanjali Ayurved ‘CORONIL’, which was also claimed as a cure for the novel coronavirus, has received a blow from the Madras HC, which has restrained Patanjali Ayurved from using the mark ‘CORONIL’ for its immunity booster.

Justice C.V. Karthikeyan passed the interim order valid till July 30 on the plea of Chennai-based company Arudra Engineering Private Limited which has claimed that ‘Coronil’ is a trademark owned by it since 1993.

According to the company which is into manufacturing chemicals and sanitizers to clean heavy machinery and containment units, it has registered ‘Coronil-213 SPL’ and ‘Coronil-92B’ in 1993 and has been diligently renewing the trademark since then.

“Currently, our right over the trademark is valid till 2027,” the company said.

Claiming that its products with the trademark have a global presence, the company claimed that its clients include BHEL and Indian Oil. To substantiate its claim, the petitioner produced sale bills of the products for the past five years.

“The mark adopted by Patanjali for its drugs are clearly identical to the marks registered by the company. Though the products sold by the company are different, the use of identical trademarks would still amount to infringement of our intellectual property right,” the company said.

“Permitting Patanjali to continue to use the mark will directly affect our reputation and the goodwill created over the mark for over 26 years in both international and domestic markets,” the petitioner added. After Patanjali launched Cornonil, the Union Ayush Ministry on July 1 had said that the company can sell the drug only as an immunity booster and not as a cure for Covid-19. Baba Ramdev had reacted to the criticism of the efficacy of Coronil, saying some people were hurt by the rise of indigenous medicine.

“The mark adopted by Patanjali for its drugs are clearly identical to the marks registered by the company,” Arudra Engineering’s lawyer argued in court. “Though the products sold by the company are different, use of identical trademarks would still amount to infringement of our intellectual property right.” Arudra Engineering argued that allowing Patanjali Ayurved to use its trademark would damage its reputation and the goodwill created by the mark for over 26 years.

Patanjali Ayurved had claimed in June that it had manufactured two drugs that showed 100% effectiveness in coronavirus patients. The Union Ministry of Ayurveda, Yoga & Naturopathy, Unani, Siddha and Homoeopathy, or AYUSH, had barred Patanjali from promoting these products. However, on July 1, the ministry said the company could sell the products, but only as medicine for “management” of the coronavirus, not for its cure. It is not known what “management” means.

India has over 10 lakh cases of the coronavirus, and more than 26,200 deaths, according to the Union Ministry of Health and Family Welfare’s latest data.

BY SIDDHARTH SONI

The Madras High Court has finally concluded the battle between two Fast Moving Consumer Goods (FMCG) manufacturers Nestle India Limited and ITC Limited over the use of the expression ‘Magical Masala’ in the former’s Maggi brand of instant noodles. The facts of the dispute are as follows:

Yippee had been using the expression of ‘MAGIC MASALA’ over its instant pack of noodles since the year 2010. However, in the present case, Nestle had pre-empted such a move by using ‘Magical Masala’ in Maggi in 2013 itself. The Hon’ble Court has held that “such adoption of the expression cannot be said to be mala fide. It was a legitimate adoption by the defendant as no person can appropriate common and laudatory words. Laudatory epithet cannot be given monopoly or protection,”. The court also pointed out that the words Magic and Masala were used widely by many in the FMCG industry.

Though Sunfeast was the first to use the expression ‘Magic Masala’ for instant noodles, Pepsico had been using the same expression for its Lay’s brand of chips even before 2010, the judge pointed out. He also said that the Annual Reports of ITC Limited clearly show that it had not conceived the expression, under contention, either as a brand or sub-brand.

Further, after comparing the wrappers of Sunfeast Yippee Noodles Magic Masala and Maggi Xtra delicious Magical Masala, the judge found them to be completely distinctive without any scope for confusion between them. Hence, the charge levelled against Nestle of misrepresentation and misleading the consumers stands disproved, he ruled.

Disclaimer: The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of any agency of the Indian government. Examples of analysis performed within this article are only examples. They should not be utilized in real-world analytic products as they are based only on very limited and dated open source information. Assumptions made within the analysis are not reflective of the position of any Indian government State.

The author is a 2nd-year law student at Symbiosis Law School, Pune.

BY SIDDHARTH SONI

Chur Chur Naan is an Indian bread that is baked in tandoor and is a famous dish. This dish sparked a legal fight between two neighborhood shops in Delhi over the trademark for ‘CHUR CHUR NAAN’.The owner of one shop, claiming that he has exclusive rights over the said trademark, sued another for blatantly copying it.

Pardeep Kumar Jain, who runs a small eatery ‘Jain’s Amritsari Chur Chur Naan’ in the busy Paharganj market, took his rival Rajan Seth to court, claiming that chur chur naan was “created” by his father in the 1980s. Jain filed a petition in the high court against Seth for using the term chur chur naan as part of his restaurant’s name. Praveen Kumar Jain (Plaintiff) is the owner of various trademarks including ‘CHUR CHUR NAAN’ and ‘AMRITSARI CHUR CHUR NAAN’ and is selling Naan and related food items in Paharganj, Delhi. Plaintiff enjoys exclusive rights under Section 28 and 29 of the Trade Mark Act, 1999 (‘Act’) therefore Plaintiff is claiming exclusive rights in the expression `Chur Chur Naan’ against the Rajan Seth (defendant) who uses a similar expression for its outlet.

The Plaintiff while relying upon several judgments namely in Automatic Electric Limited v. R.K. Dhawan & Anr. 77(1999) DLT 292 (hereinafter referred to as, “Automatic Electric”) and The Indian Hotels Company Ltd and Ors. v. Jiva Institute of Vedic Science and Culture 2008 (37) PTC 468 (Del) (hereinafter referred to as, “Jiva Institute”), contended that since Defendants themselves having applied for the registration of the mark ‘PAHARGANJ KE MASHOOR CHUR CHUR NAAN‟, they are estopped from claiming that the expression ‘CHUR CHUR NAAN‟ is generic and descriptive.

Plaintiff contended that it enjoys an enormous reputation and this is evident from the fact that the Plaintiff has been covered on television channels as Paharganj Ke Mashoor Chur Chur Naan and the said fact shows that the Plaintiff is entitled to an injunction owing to the extensive goodwill which it enjoys. The Plaintiff further submitted that various marks such as ‘EENADU’ and ‘PAKWAN’ which are also descriptive have already been protected by Courts. In lieu of the above, the Plaintiff sought an injunction against the Defendant Nos.1 and 2 from using the name ‘PAHARGANJ KE CHUR CHUR NAAN’ and ‘AMRITSARI CHUR CHUR NAAN’.

It is the submission of the defendants that there are a large number of outlets that use the name ‘CHUR CHUR NAAN‟. It was further submitted that the trademarks of the Plaintiff are liable to be rectified as they lack basic distinctiveness. The Defendant also contended that ‘PAHARGANJ KE MASHOOR CHUR CHUR NAAN‟ is completely descriptive, no monopoly can be granted to such descriptive/generic expressions.

The Hon’ble Delhi High Court, after quashing the plaintiff’s petition, has held that

“There is no doubt that the Plaintiff does have registrations for the marks ‘CHUR CHUR NAAN‟ and “AMRITSARI CHUR CHUR NAAN‟. The registrations thus confer exclusive rights as per Section 28 of the Act. However, the rights of a registered trademark holder are not absolute inasmuch as both Section 28 & 29 are subject to the exceptions carved out to infringement of registered trademarks. Under section 35 of the Act (Refer to Section 35 at the end of the brief), if there is a bona fide description of the character or the quality of the goods or services, there cannot be an infringement of a registered trademark.”

Expressions such as ‘NAAN, CHUR CHUR NAAN, AMRITSARI CHUR CHUR NAAN” are similar to expressions such as Amritsari Kulcha, Malabar Parantha, Hyderabadi Biryani, Kashmiri Dum Aloo, Chettinad Chicken, Murthal ke Paranthe, Mangalore idli, etc., and such other food products which are used in common parlance by the general public. The word ‘CHUR CHUR‟ merely means `crushed’ and `Chur Chur Naan’ means `Crushed Naan’ and nothing more. It is incapable of acquiring trademark signification. ‘CHUR CHUR‟ is a terminology which is used in normal conversational language and there cannot be any monopoly in respect of an expression such as “CHUR CHUR‟. The Plaintiff has obtained registration of the marks ‘CHUR CHUR NAAN, AMRITSARI CHUR CHUR NAAN’, but the same would not in any manner prevent the bonafide description of the character of the naan which is crushed i.e. ‘CHUR CHUR NAAN’.

In addition, HC mentioned that incase the registrations are wrongly granted or applied for in respect of completely generic expressions, the Court cannot ignore the generic nature of the marks and confer a monopoly on the same in favor of any party. In the present case, the issue is that the expression is completely generic.

Delhi High Court held that it cannot ignore the generic nature of the marks and confer a monopoly on the same in favor of any party. However, in order to avoid confusion Defendants agreed to change its name of their outlets to ‘PAHARGANJ SETH KE MASHOOR CHUR CHUR NAAN’ and ‘PAHARGANJ SETH KE MASHOOR AMRTISARI NAAN’ while ensuring that entire name shall be used in the same font, color and in the same style without giving any undue prominence to ‘CHUR CHUR NAAN’ or ‘AMRITSARI CHUR CHUR NAAN’ in 30 days.

Disclaimer: The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of any agency of the Indian government. Examples of analysis performed within this article are only examples. They should not be utilized in real-world analytic products as they are based only on very limited and dated open source information. Assumptions made within the analysis are not reflective of the position of any Indian government State.

The author is a 2nd-year law student at Symbiosis Law School, Pune.

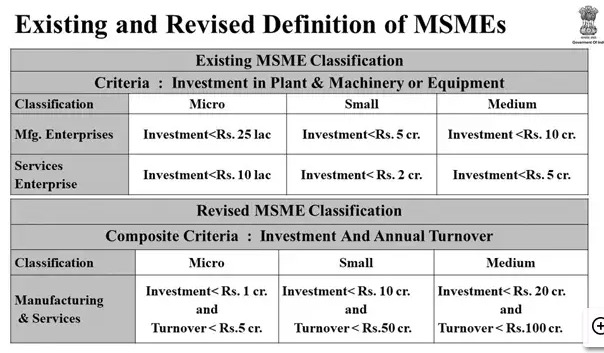

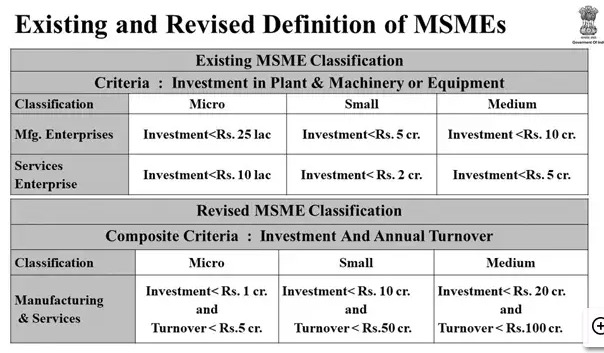

The Micro- Small and Medium Enterprises (MSMEs) are small sized entities, defined in terms of their size of investment. They are contributing significantly to output, employment export etc. in the economy. They perform a critical role in the economy by providing employment to a large number of unskilled and semi-skilled people, contributing to exports, raising manufacturing sector production and extending support to bigger industries by supplying raw material, basic goods, finished parts and components, etc. The existing MSME definition was based on the criteria of Investment in Pant Machinery or Equipment. However, our Hon’ble Finance Minister Nirmala Sitharaman announced a new definition for MSMEs. The composite criterion is now changed to Investment and Annual Turnover. The table for the revised definition of the MSMEs is provided below:

Benefits for MSME Registration

1. Bank Loans (Collateral Free)

The Government of India has made collateral-free credit available to all small and micro business sectors. This initiative guarantees funds to micro and small sector enterprises. Under this scheme, both the old as well as the new enterprises can claim the benefits. A trust named The Credit Guarantee Trust Fund Scheme was introduced by the GOI(Government Of India), SIDBI(Small Industries Development Bank Of India) and the Ministry of Micro, Small and Medium Enterprise to make sure this scheme is implemented (Credit Guarantee Scheme) for all Micro and Small Enterprise.

2. Subsidy on Patent Registration

A hefty 50% subsidy is given to the Enterprise that has the certificate of registration granted by MSME. This subsidy can be availed for patent registration by giving application to respective ministry.

3. Overdraft Interest Rate Exemption

Businesses or enterprises registered under MSME can avail a benefit of 1% on the Over Draft as mentioned in a scheme that differs from bank to bank.

4. Industrial Promotion Subsidy Eligibility

Enterprises registered under MSME are also eligible for a subsidy for Industrial Promotion as suggested by the Government.

5. Protection against Payments (Delayed Payments)

At times, the buyers of services or products from the MSME’s or SSIs tend to delay the payment. The Ministry of Micro, Small and Medium Enterprise lend a helping hand to such enterprises by giving them the right to collect interest on the payments that are delayed from the buyer’s side. The settlement of such disputes must be done in minimum time through conciliation and arbitration.

In case, if any MSME registered enterprise supplies any goods or services to a buyer then the buyer is required to make the payment on or before the agreed date of payment or within 15 days from the day they had accepted the goods and services from MSME or SCI registered business( if there is no mention of the date of payment).

If the buyer delays the payment for more than 45 days after accepting the products or services then the buyer has to pay compound interest along with interests (monthly) on the amount that was agreed to be paid. The interest rate is three times the rate that is notified by the Reserve Bank of India.

6. Reduction in Electricity Bills

This concession is available to all the Enterprises that have the MSME Registration Certificate by providing an application to the department of the electricity along with the certificate of registration by MSME.

7. ISO Certification Charges Reimbursement

The registered MSME enterprises can claim the reimbursement of the expenses that were spent for the ISO certification.

8. Priority Lending

Our first MSME benefit is priority lending. Whether you’re the proud owner of a cutting-edge technology business or a masala packing company, employing rural women, credit and loan is something that your business will inevitably require for long- and short-term financing. Banks, by virtue of the directions issued by the Reserve Bank of India, have certain earmarked funds that have to mandatorily be given to MSME businesses. Producing MSME certificate benefits to entitle one to avail this loan on a priority basis with fewer hassles.

9. Income Tax Exemption

There are several MSME registration benefits that can save lakhs of the amount that may be assessable to tax in the absence of this certificate. The benefit of a presumptive basis of taxation is available to enterprises, which relieves one from maintaining detailed books of accounts and undergoing audit procedures.

10. Technology and quality up-gradation support to MSMEs

In order to enhance the cost-effectiveness and promote clean energy use in manufacturing, the government reimburses project costs towards these goals for MSME sector units and also expenditure incurred for the implementation of clean technology, preparation of audit report and subsidies for licensing products according to national and international standards.

11. Exclusive purchases and sheltering from the competition:

As part of the MSME Market Development Assistance Scheme, the Central Government follows a Price and Purchase Preference policy. Wherein more than 358 items are listed under it for exclusive purchases by Central Government from the medium, micro and small units only.

12. Market assistance from the government and Export Promotion

The Government of India organizes several exchange programs, craft fairs, exhibitions, and trade-related events internationally. Being categorized as a micro, small or medium enterprise gives access to all of these platforms for international cooperation on trade-related aspects with different countries and fosters new business connections. The government also incentivizes the export of goods and services by MSMEs by way of subsidies, tax exemption, and technical support.

13. Credit Linked Guarantee Scheme

The Ministry of Micro, Small and Medium Enterprises and the Small Industries Development Bank of India (SIDBI) have established a Trust named Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) specifically to implement Credit Guarantee Fund Scheme for micro and small enterprises. This scheme allows collateral-free loans of up to 50 lakhs for individual MSMEs.

14. Goods and Services Tax

Several indirect tax reforms have been proposed to improve compliances such as a simplification of GST returns, automation of GST Refund, introduction of electronic invoice to facilitate compliance and return filing, Aadhaar based verification of taxpayers to weed out dummy or non-existent units, usage of deep data analytics and AI tools to crackdown GST input tax credit, refund, and other frauds. GST rate structure is also being deliberated so as to address issues like inverted duty structure.

Rs. 20 Lakhs Crore Package and the MSMEs

Big Boost to the MSME sector in sync with the Atmanirbhar Bharat announcement. The package provides more liquidity to MSMEs, raises the bar for investment and turnover and removes the distinction between the manufacturing sector and the service sector. This is further strengthened by the boost given to NBFCs/housing finance companies and microfinance institutions wherein they have been permitted to buy debt payable documents under full guarantee from the Government of India. As a result, it will not only provide liquidity but generate jobs and enable the journey towards realisation of atmanirbhar bharat motto. Further, with doing away from the global tender route, these MSMEs will also be able to work on contracts upto Rs 200 crore which earlier was not within their domain due to technicalities.

6 Measures and ‘AATMANIRBHAR’ MSMEs

- Credit and Finance for MSMEs:Out of the 15 relief measures announced by the Finance Minister Nirmal Sitharaman on Wednesday under the mega Rs 20 lakh crore stimulus package for the Covid-battered economy, six aimed at bringing lockdown-hit India’s vast MSME sector back to life. MSMEs across sectors and industries have been clamouring for a financial package from the government ever since the lockdown came into force on March 25. Sitharaman sharing the details of the humongous Covid-19 financial package – roughly 10 per cent of the Indian GDP – announced measures to boost liquidity in MSMEs, help them take benefit of the government schemes, enable them to compete with foreign companies, and strengthen their network.

- Rs 3 lakh crore collateral-free loans: Banks and NBFCs will offer up to 20 per cent of entire outstanding credit as on February 29, 2020, to MSMEs. Units with upto Rs 25 crore outstanding credit and Rs 100 crore turnover are eligible for taking these loans that will have four-year tenor with a moratorium of 12 months on principal payment. The scheme can be availed till October 31, 2020. The government will provide complete credit guarantee cover to lenders on principal and interest amount.

- Rs 20,000 crore subordinate debt: MSMEs declared NPAs or those stressed will be eligible for equity support as the government will facilitate the provision of Rs 20,000 crore as subordinate debt. The government will also provide Rs 4,000 crore to CGTMSE that will offer partial credit guarantee support to banks for lending to MSMEs.

- Rs 50,000 crore equity infusion: The government will infuse Rs 50,000 in equity in MSMEs through a Fund of Funds that will be operated through a Mother fund and a few daughter fund. The Fund of Funds will be set-up with a corpus of Rs 10,000 crore to give equity-based funding to MSMEs having growth potential and viability. It will also urge MSMEs to list on stock exchanges.

- Revised MSME definition: To address MSMEs fear of outgrowing in size to receive benefits given by the government to businesses categorized as per the current MSME definition, Nirmala Sitharaman on Wednesday revised the definition. Under the new definition, manufacturing and service MSMEs will be defined under a common metric that will be a mix of investment in plants and machinery or equipment and turnover.

- Global tenders disallowed: Addressing MSMEs’ issue of unfair competition from foreign companies in government procurement tenders due to the size and strength differ, the government said it will not allow global tenders in such schemes upto Rs 200 crore. Necessary amendments of General Financial Rules will be effected, according to the government document detailing the 15 relief schemes.

- Clearing MSME Dues: Our Hon’ble Finance Minister Nirmala Sitharaman said that the government and central public sector enterprises will release all pending MSME payments in 45 days. The minister also said that fintech enterprises will be used to boost transaction-based lending using the data by the e-marketplace. This e-market for developing linkages for MSMEs will be promoted to replace trade fairs and exhibitions.

BY SIDDHARTH SONI

With the novel coronavirus bringing whole world to a standstill, it is said that this virus has its origins in the wet markets of Wuhan, China. In the month of December 2019, few doctors from Wuhan identified that a new strain of the Coronavirus family, SARS-CoV-2, was causing respiratory problems in humans. It is being alleged that Chinese government is responsible for not containing the virus when it was identified at its first instance. This negligence by the Chinese government led to the virus being mass-proliferated and progressing to different parts of the world. This has sparked debates all around the globe. This article would focus on affixing China’s liability for the trans-boundary harm that this novel coronavirus has caused.

State Responsibility of China

The customary rules for affixing state responsibility on states are included under the 2001 Draft Articles on the Responsibility of States for Wrongful Acts (‘ARSIWA’). Wrongful acts which are attributable to the state and which also constitute a breach of international obligations are defined in Article 2 of this document. Article 4 of the same document focusses on the state’s responsibility if the act is perpetrated through legislative, executive or judicial branches of the government. The information about the virus flowed from the Wuhan Institute of Virology (WIV) to the local Wuhan authorities, all being considered as the organs of the Chinese government. Stressing on the international obligations that the Chinese government has failed to commit to, it had failed to adhere with its due diligence obligations by not sharing relevant and timely information deliberately and through gag orders, ordering biotech companies to stop testing. Due diligence is a standard of good governance, assessing whether a state has done what was reasonably expected of it when responding to a harm or danger. China also seems to violate Article 14 of ILC Draft Articles by not fulfilling to promptly and transparently sharing information with the World Health Organisation in accordance with the International Health Regulations. The International Health Regulations, 2005 binds all the WHO signatories. The major focus of these health regulations is to report disease outbreaks rapidly and transparently.

Article 4 of the same health regulations mandates the establishment of a national IHR focal point by the government, which is used to timely notify about disease outbreaks. Article 5 requires a country to develop core capacities to ‘detect, assess, notify, and report events’ under the IHR. The Ministry of Health in China was designated as the focal point, while China also ensured that it’s public health capacity met the IHR requirements. Therefore, China had the infrastructure to respond to the COVID-19 outbreak more efficiently, under its primary obligations in the IHR. In accordance with Article 6(1) of these health regulations, a country is mandated to inform the WHO about the activities which can be considered as Public Health Emergencies of International concern. China claims to have informed the WHO about the outbreak of the virus, but actually informed about the same after a few days later, which constitutes to the non-fulfilment of its international obligations. China had refused to share the spread of the infection amongst the healthcare workers, which makes it liable under Article 7 of the IHR.

Law on Trans Boundary Environmental Damage

The law on Trans Boundary harm was first discussed in the Trail Smelter arbitration, which states that sovereignty of a state us not absolute in nature and that it cannot be used to harm another nations state. Principle 21 of the Stockholm Declaration further clarified rather went on to impose responsibility upon nation States for ensuring that activities within their jurisdiction or control do not cause damage to the environment of other States or of areas beyond the limits of national jurisdiction. This principle was upheld by the International Court of Justice in its Nuclear Weapons Advisory Opinion, wherein it stated the due diligence obligations upon nation states in Trans boundary contexts. In yet another case of Ecuador vs. Columbia (2008), ICJ focussed on the international obligations of Columbia which led to the spray of a herbicide in the territory of Ecuador. Under Article 3 of the International Law Commission’s on Transboundary harm, China can be held accountable for violating its duty of due diligence and not taking appropriate measures to prevent a trans boundary harm.

Jurisdictional Challenges

Article 75 of the WHO constitution states that ICJ can have jurisdiction over the settlement of disputes relating to the WHO Constitution. The jurisdictional challenge in today’s times would be that of the fact that disputant parties are free to choose any mode of dispute settlement instead triggering ICJ jurisdiction. In this context, it would be very challenging for the states wishing to impose liability on China. International adjudication is consent-based is extremely crucial to drag up a nation to the world court for non-fulfilment of its international obligations. In this context, China would never consent on referring its case to the International Court of Justice. Despite the challenges, some states have tried to make China liable for its actions. Missouri, a state in the United States was the first ones to sue China alleging suppression of information, arrest of several whistle-blowers and spreading the disease that has led to the cause of huge amount of lives and has also caused an ‘irreparable damage’ to several nations.

China can also be held guilty under Article 7(1) of the Statute of the International Criminal Court, which talks about ‘other inhumane acts of a similar character intentionally causing great suffering, or serious injury to body or to mental or physical health” as mentioned under ‘crimes against humanity.’ The prosecutor’s office has authority to conduct proceedings proprio motu under Article 15. Though China is a non-signatory to the Rome Statute, the prosecutor can be allowed to conduct investigations on the same.

Also, if United States wished to bring a lawsuit against China, courts in the United States would not have the jurisdiction since countries are protected from being sued in US courts by the Foreign Sovereign Immunities Act (FSIA), which was first enacted in 1976.

Appropriate forum to ascertain China’s Responsibility

With the jurisdictional challenges in hand, the International Criminal Court (ICC) seems to be the perfect forum to affix China’s liability for the outbreak. But there seems to be an issue of ICC’s Jurisdictional Regime. The ICC is concerned with trying and punishing individuals (and not States) who commit crimes against international law. The Nuremberg Tribunal in 1946 ascertained that “Crimes against international law are committed by men, not by abstract entities, and only by punishing individuals who commit such crimes can the provisions of international law be enforced.” Article 25 of the Rome Statute signifies philosophy of ‘individual criminal responsibility’. To ascertain that China is responsible for the spread of the outbreak, the need of identifying the individuals who perpetrated the crime of creating/spreading the COVID-19 virus arises. Recently, pleas were filed before the ICC by individuals from both the United States and India. Individuals who have been referred to in this plea are the President of China, the General of the Chinese Army, and the Director of the Wuhan Institute of Virology.

Despite these challenges, procedural and investigative difficulties cannot be ignored. Another challenge would be that the jurisdiction of the court can be affixed only on those who are state parties to the Rome Statute. China, not being one of the state parties, has to accede to the jurisdiction of the ICC in this case, which it would never do. However, under Article 13(b) of the Rome Statute, the Security Council is empowered to refer the matter in hand to the prosecutor of ICC. Also, the UN General Assembly’s ‘Uniting for Peace’ resolution can be used to a great extent that allows for the General Assembly to consider the matter in question if the Security Council ‘fails’ to discharge its duty due to lack of unanimity. While not explicitly stated in the Rome Statute, academically speaking, the Uniting for Peace resolution could be invoked to refer a case involving a non-State Party to the ICC.

Conclusion

Despite the jurisdictional challenges that the nations would face to bring China’s guilt in front of the world, the Law on Trans Boundary Environmental Damage can be utilized to a great extent. After analysing the legal liability of China, it is clear that China has somewhere failed to observe due diligence. If it had done so, the world would have been a better place to live in. While undertaking commercial activities in the wet markets of Wuhan, where meat of animals is consumed in huge quantities, China has failed to comply with its international obligations under the International Health regulations, 2005 and also provisions relating to State Responsibility.

Disclaimer: The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of any agency of the Indian government. Examples of analysis performed within this article are only examples. They should not be utilized in real-world analytic products as they are based only on very limited and dated open source information. Assumptions made within the analysis are not reflective of the position of any Indian government State.

The author is a 2nd-year law student at Symbiosis Law School, Pune.

BY SIDDHARTH SONI

Introduction

While the whole world battles with the current pandemic, search for the drug which can be a cure for COVID-19 is still in progress. A patent bestows a right in the author to stop others from copying, manufacturing, selling or importing your invention without the permission from the author. One of the main advantages of securing a patent is that the author gets an exclusive right to license or sell the patent. This can be an important source of revenue when it comes to business. Sometimes, the existence of some businesses solely depend on collection of royalties from a patent that they have licensed. But there also exists some limitations and restrictions on patents. One of them being, Compulsory Licensing, means that the government can allow other manufacturers to produce a patented product or a process without the consent of the actual owner. The article further focusses on when can a patent be licensed? What happens to the rights of the patent owner in a time of National Emergency.

Compulsory Licensing & the TRIPS Agreement

Some of the important changes that the TRIPS agreement introduced were pharmaceutical patent protection. Developing countries found it difficult to access to affordable drugs. Major pharmaceutical companies all started to license their drugs for high revenues, which ultimately gave a blow to the poor and needy nations. Access to affordable drugs and medicines cannot be ignored in developing countries. The TRIPS agreement enlists a number of conditions that are required for issuing a compulsory license. One of the conditions include prior negotiation of the owner of the patent with the licensee to obtain a license on reasonable costs. However, Article 31(b) of the TRIPS agreement provides for waiver of the conditions in case of a national emergency.

What amounts to a National Emergency?

The TRIPS agreement is silent on what constitutes a ‘national emergency’. Indeed, some businesses exist solely to collect the royalties from a patent they have licensed – perhaps in combination with a registered design and trade mark. Indeed, some businesses exist solely to collect the royalties from a patent they have licensed – perhaps in combination with a registered design and trade mark. National Emergency, as defined in the Black’s Law Dictionary is a state of national crisis and is a situation demanding immediate and extraordinary national or federal protection. The Doha Declaration on the TRIPS agreement and Public health states the situations that can be considered as instances of national emergencies. There have been many instances where countries considered compulsory licensing during a national emergency, for example, Zimbabwe declared a period of national emergency for 6 months to contain the spread of HIV/AIDS, which in turn enabled the government of Zimbabwe or any person authorised by the state to make, use or import any generic antiretroviral drug (ARV).

India and Compulsory Licensing

The Indian Patent Act, 1970 deals with the conditions for compulsory licensing which are mentioned under §84 and §92 of the said act. Any person, under §84, after three years from the date of grant of that patent, can make an application for grant of a compulsory license. In current situation of a pandemic, the government would be most interested in acquiring compulsory licenses to make drugs and other patented products accessible to citizens at affordable prices. It was in the case of Natco vs. Bayer, that the Controller of Patents was of the opinion that expensive patented drugs should be made available for compulsory licensing. §92(3)(i) of the Indian Patent Act, 1970 states that a third party during a situation of national emergency, shall not apply any procedure specified in §87 in relation to that application for grant of licence. It includes public health crisis situations such as Acquired Immuno Deficiency Syndrome, Human Immuno Deficiency Virus, tuberculosis, malaria or other epidemics.

India’s reaction to Compulsory Licensing in times of a Pandemic

In rise of the current pandemic, many countries have started resorting to compulsory licensing in such an emergency situation. Critical supply shortages of medical devices and medicines had been have proved to be major challenges before the government. Countries that have large scale production capacity for medicines such as India and China have widely patented a drug called Remdesivir. Remdesivir originally developed for other viral infections, including Ebola and the Marburg virus, is a patented product of Gilead Pharmaceuticals and is known to be a promising drug for the cure of Covid-19 Virus. Gilead submitted a request to the FDA to cancel its seven-year orphan drug regulatory exclusivity for potential Covid-19 treatment Remdesivir. Meanwhile, Medtronic agreed to share publicly its proprietary design specifications for the PB560 ventilator. These steps to share the drug for licensing are some major steps taken by big pharmaceutical companies for the development of the industry. Meanwhile, Israel have issued compulsory patent licenses related to lopinavir/ ritonavir (brand name Kaletra). Israel is one of the few countries that is always ready to share patented drugs as a compulsory license.

India currently is struggling with shortage of PPE Kits, 3-ply masks, N-95 masks. The struggle is driven by shortage of raw materials and the lack of technical expertise required to manufacture such high-end products. Many pharmaceutical companies such as the Pune based Serum Institute of Technology claims to have the vaccine in 3 weeks, and it promises not to patent the vaccine and share the same by granting licenses to other pharmaceutical companies.

Conclusion

While the sole purpose of Compulsory Licensing is to reduce the prices of pharmaceutical drugs by minimizing the monopoly in the pharmaceutical industry, it also negates the primary benefit to the patent owner of licensing the patent to third-parties by earning royalties. The vaccine, if developed by any country would undergo compulsory licensing to curb the effect of the virus as soon as possible. Due to this, many pharmaceutical companies do not wish to contribute to the development of vaccine for the novel Coronavirus, Covid-19 as they would not be able to earn any royalty if they invest all their resources for the development of the vaccine. This seems to be a serious issue as this would hinder the struggle towards fighting this novel coronavirus.

Disclaimer: The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of any agency of the Indian government. Examples of analysis performed within this article are only examples. They should not be utilized in real-world analytic products as they are based only on very limited and dated open source information. Assumptions made within the analysis are not reflective of the position of any Indian government State.

The author is a 2nd-year law student at Symbiosis Law School, Pune.

BY SIDDHARTH SONI

Introduction

MSMEs (Micro, Small & Medium Enterprises) all sized business units defined as per the terms of their investment. According to §7 of the Micro, Small & Medium Enterprises Development (MSMED) Act, 2006 segregates MSMEs into two categories, one being manufacturing and the other being services. MSMEs form the basis of the Indian economy and provide employment opportunities to thousands. The Indian Government in June 2018 allowed promoters to bid for enterprise undergoing Corporate Insolvency Resolution process (CIRP), thus providing huge reliefs to MSMEs facing Insolvency proceedings under the Insolvency and Bankruptcy Ordinance, 2018. After the President assented to the ordinance, the IBC Ordinance brought in important changes for MSMEs. The present article focusses on the potential threats that would be faced by MSMEs and what are the available measures under the IBC to protect them.

Potential Threats that MSMEs could face under IBC

MSMEs contribute to about 48 percent of India’s total exports and about 28 percent to the total GDP of the country. The first and the foremost being that MSMEs would not be able to recover their due amount of money from their corporate debtors. MSMEs get nothing if their buyer undergoes IBC and thus this recovery process under the IBC is just unfair and one-sided. Another concern being that there exists no feasible plan which can prove to be useful in case the promoters of MSMEs are given a fair opportunity for participating in the resolution plan. Certain in-qualification standards for promoters are mentioned under §240A of the Insolvency and Bankruptcy Code, 2016. Another threat that the MSMEs are concerned with is the speedy and a cost-effective resolution method. In lieu of this, pursuing a debt through the IBC route sometimes becomes challenging for the MSMEs. When compared with big corporates, MSMEs seem to dace many challenges yet threats for their regular functioning.

Amendments required for the benefits of MSMEs

In a bid to encourage entrepreneurs to enter into a business and to encourage sustainable growth of the credit market in India, below mentioned are some recommendations. These recommendations were also given Injeti Srinivas Committee in 2018:

- MSMEs should be exempted under the application of §29A of the IBC because the only people who are interested in acquiring an MSME are its promoters.

- The Central government should exempt or vary application of provisions of the Code by way of a notification for a certain class or classes of companies, including for MSMEs.

- MSMEs should be provided with a relief from the provision of the Code by inserting §240A in the Code, which specifically exempts resolution applicants for MSMEs that are undergoing CIRP from all eligibility criteria stated in §29A except the requirement that they should not be classified as wilful defaulters.

It is important for the smooth functioning of MSMEs, that they must be free from threats that might possibly cause huge harm to the MSMEs. The Hon’ble Supreme Court in the case of Swiss Ribbons Pvt. Ltd. vs. Union of India and Ors., was of the opinion that MSME friendly provisions should be added in the IBC and MSMEs should be exempted under §29A of the Code. The IBC Amendment Ordinance 2018 included Section 240A in the Code which specifically dispenses the applicability of Section 29A clause (c) and (h) of the Code, in case the Corporate Debtor is an MSME, which relates to such promoters who have become NPA can also bid for their companies. NCLAT was in another judgement of Saravana Global Holdings Ltd. & Anr. Vs. Bafna Pharmaceuticals Ltd. & Ors. held that ‘The intention of the legislature shows that the Promoters of ‘MSME’ should be encouraged to pay back the amount with the satisfaction of the ‘Committee of Creditors’ to regain the control of the ‘Corporate Debtor’ and entrepreneurship by filing ‘Resolution Plan’ which is viable, feasible and fulfils other criteria as laid down by the ‘Insolvency and Bankruptcy Board of India’.

Even the Ministry of Finance, in a series of tweets, mentioned that the IBC Ordinance of 2018 will boost the MSME sector by providing them with a special dispensation in the insolvency process. “Exemption from various provisions in the Resolution process will help the MSMEs turnaround faster”, said the ministry.

Effect of Covid-19 on MSMEs

The Indian Economy has hit hard due to the current pandemic. With more than half of the world pushed back into recession, 2020 seems to be worse than the global financial crisis in 2007-08. With sharp-rise of cases across several countries, the economic damage in these countries would experience a steep increase. Moreover, the International Monetary Fund has predicted that this pandemic would instigate the worst recession since the Great Depression of 1929. As a preventive measure to the upcoming recession, governments have now started pressurizing employers to pay wages to their employees without doing any work.

The Indian Government issued an order dated 29th March, 2020 which stated that employers deducting wages of their employees during the lockdown period would be held legally accountable. The national lockdown was clamped by the Home Ministry by invoking the National Disaster Management Act, 2005 along with the Epidemic Diseases Act, 1897. The ministry stressed on the closure of all commercial and private establishments, all transport services, industrial establishments, educational institutions exempting essential services. The Government wants the employers of any kind not to deduct any salaries of their employees during this lockdown period. MSMEs seem to be effected from this order, as providing all the workers with remuneration for the lockdown period would lead several MSMEs to be pushed into state of insolvency.

The Hon’ble Supreme Court in the case of Chief Regional Manager, United India Insurance Company Limited v. Siraj Uddin Khan [Civil Appeal No. 5390 of 2019, decided on 11 July 2019] decided that no employee can claim wages for the period that he/she remained without leave or justification. In the present circumstances, neither the employees offer work nor the workers would be able to report their work. Also, not each and every work be completed through technology and also work from home cannot be thought of as an alternative to the works done at grass-root levels. Therefore, the principle of ‘No work, no pay’ cannot be invoked in the present circumstances. There have been several reports that certain MSMEs are uncertain of paying salaries to their employees amidst the lockdown.

Government’s Reaction to protect MSMEs

A list of Covid-19 operations were released by the Reserve Bank of India. Banks have been advised to achieve a 20% year-on-year growth in credit to micro and small enterprises, and a 10% annual growth in the number of micro enterprise accounts, said the recommendations of the Prime Minister’s Task Force on MSMEs. Banks have been permitted to categorise their MSME general banking branches having 60% or more of their advances to the MSME sector. Several measures have been taken by the government including protection of credit-loss and credit sanctioning official, introducing Cluster-based approach, manging a Simplified loan processing and assessment and the establishment of a Central Research Institute to foster a conducive environment for the growth of entrepreneurs and development of skill sets and dissemination.

Conclusion

Considering the employment opportunities provided by the MSMEs, the Indian Government would need to come up with a scheme to subsidize employers towards the wages paid during the lockdown. The scheme can be linked to profits earned by the industrial establishment and the wage bill for a month. In the absence of such a scheme, private employers especially small and medium industries will be put through hardships that could even bankrupt them. The government while drawing a stimulus or revival plan for the economy should certainly consider subsiding the wage cost for the lockdown period, if not in entirety, at least in part. If for any reason the government decides to extend the lockdown it should bear the wage burden and should not give any advisory for payment of full wages given it lacks the authority to do so. Maybe, the Govt can advise the establishments to bear/ pay only the necessary amount which is required for subsistence of living or payment of some school fee expenses, which are bare minimum for running the household; which is today being run with zero petrol expenditure, and zero entertainment expenses. Only a proportion of wage expense can be borne by the employers.

Disclaimer: The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of any agency of the Indian government. Examples of analysis performed within this article are only examples. They should not be utilized in real-world analytic products as they are based only on very limited and dated open source information. Assumptions made within the analysis are not reflective of the position of any Indian government State.

The author is a 2nd-year law student at Symbiosis Law School, Pune.